ENG

-

ABOUT US

James Forwarding

- BUSINESS

-

JFC NEWS ROOM

JFC NEWS ROOM

-

CONTACT US

CONTACT US

JFC NEWS

2021.01.12 Year of 2021 OUTLOOK : Altogether, apart-Global Trade policy issues

- 2021-01-12

- 562

While it’s tempting to focus on the early moves of the Biden administration or the fallout from Brexit, global trade policy developments in 2021 will yield just as many threats and opportunities as developments in the Atlantic basin.

See you in ’22 – World Trade Organization reform

Ongoing delays to the next ministerial meeting of the World Trade Organization will likely be extended to Dec. 2021. The strictures of the pandemic are the main reason though the yet-to-be-completed appointment of a new Director General and the necessity of including the Biden administration’s engagement in the process of reforming the WTO are also likely to be factors.

President-elect Biden has indicated that multilateralism is back on the agenda, particularly with regards to China’s growing influence over global organizations, but also that trade policy is not a high priority. Only 30% of the respondents to our webinar poll held on Dec. 16 expect a full reformation of the WTO being deliverable in the next four years.

A major task for the WTO in 2021 will be to manage down the number of pandemic related trade restrictions on medical supplies and food. While these peaked at 177 measures in April they have still only declined to 121 measures at year end, Panjiva’s analysis of WTO data from Nov. 18 shows. A resurgence in the pandemic and rollout of vaccines may see a return of such approaches, including India’s apparent bar on exports for private sale by Serum Institute, limiting activity in medical supply chains.

Source: Panjiva

Exporting environmental policy via imports – Carbon border taxes

The European Union’s wide ranging environmental policy could yield a carbon border tax package in 2021, particularly in the wake of recently increased commitments to reduce greenhouse gas emissions and include the shipping industry in the EU emissions trading scheme. Yet, the measures may be delayed by the need to make them WTO compliant.

As with digital services taxes (see below) there may be an imperative to reach an OECD-level agreement to include the incoming Biden administration. While the President-elect has indicated that environmental issues will be “at the table” while a U.S.-EU trade deal could form the hub of a global carbon border tax system. Yet, when it comes to negotiating trade deals he is not in an apparent rush to sign them and in any event Congress’s cooperation is not assured.

Initial CBTs will likely be focused on products where there is a simple connection between the product and its emissions profile, for example in base metal products where significant electricity of coal inputs are an issue. Secondary emissions associated with complex manufactured products, for example car parts made from steel or even vehicles themselves, are unlikely to be in early rounds of taxes purely for complexity reasons.

The actions of the largest importers will likely drive regulations globally. In the case of base metal products excluding ores the EU (excluding intra-EU trade) and U.S. accounted for 18.3% and 13.4% of global imports respectively in 2019, Panjiva’s data shows.

China meanwhile accounted for 16.4% of the total and may consider some form of carbon border taxes as it looks to deliver President Xi’s environmental targets, set as emissions per unit of GDP, in the context of the 14th Five Year Plan. With Asia ex-China representing 45.3% of the total it may require concerted action at the ASEAN or RCEP group levels to deliver a globally consistent plan.

Source: Panjiva

Looking for common virtual ground – Digital services taxes

The Trump administration has launched section 301 reviews of digital services taxes applied initially in France and more latterly across the EU as well as India, Indonesia, Turkey and the U.K. Tariffs resulting from the French review are due to be applied from the start of January 2020 while a decision in the wider review could also come in early January. While the tariffs may be of limited relevance given the Trump administration is near the end of its term and the Biden administration has committed to reducing trade frictions with America’s allies.

A wider OECD-level process may provide the way ahead with the aim of reaching an initial set of agreements by mid-2021. That may be contingent on international deal making more broadly being able to overcome the disruptions caused by the pandemic.

Digital services tax proposals have typically been designed to capture between 2% and 7.5% of revenues earned within the relevant country with a minimum threshold to protect start-up firms. Panjiva’s analysis of S&P Global Market Intelligence data shows that the U.S. accounted for an average 56.8% of 20 top internet-focused businesses in 2019 while their average ratio of taxes to revenues was 2.2%.

Facebook and Alphabet (Google) were both less exposed to the U.S. than average and have higher tax rates as a proportion of revenues while Booking had the highest tax rate of the sample at 7.3% and the lowest proportion of revenues in the U.S.

Source: Panjiva

Delivering RCEP, developing CPTPP

One of the major positive developments in global trade policy in 2020 was the final agreement to form the Regional Comprehensive Economic Partnership (RCEP), an ASEAN-centered group that also includes China, South Korea and Japan among others and that will result in a widespread cut in duties. The challenge for 2021 is to ensure the RCEP is both ratified and entered into local laws. That’s far from simple given the requirement that six ASEAN countries and three others ratify it before the rules come into force.

At the same time the RCEP’s long time rival / comparator CPTPP may finally begin to expand with Japan, its largest member, actively looking to bring in new members in 2021. The Chinese government has already indicated a desire to enter CPTPP, though that may be more about putting pressure on the Biden administration to act. Other governments that have expressed an interest in joining include South Korea, Taiwan and, somewhat strangely, the United Kingdom as it looks to bolster its post-Brexit free trade exposure.

Aside from China, other countries that are in RCEP but not CPTPP may consider membership of the latter or instead to pursue additive trade deals, as Indonesia has recently completed with South Korea.

Panjiva’s data shows that Indonesia’ bilateral trade ( imports plus exports of goods) with South Korea reached $15.6 billion in 2019, or 1.4% of Indonesia’s GDP after growth of 4.5% annually in the prior three years. Trade with the RCEP group meanwhile was equivalent to 18.8% after growth of 7.8% annually. Joining CPTPP would only bring trade worth an additional 0.4% of GDP, better to pursue the U.S. where trade accounted for 2.4% of GDP.

Source: Panjiva

Delivering AfCFTA’s promise

The AfCFTA came into force from Jan. 2021 after ratification by 33 countries. It remains to be seen if many of the countries that ratified it can execute on its promise to transform African trade with significant legislative and regulatory reforms required at the national level.

The opportunity to boost intra-African trade remains significant. Panjiva’s data shows that trade within Africa accounted for 22.6% of exports in 2019 among the 61.7% of countries that reported data. That marked an increase from 18.3% in 2018, and 19.7% in 2017. Southern and Eastern African regions lead the pack in terms of home continent trade in absolute terms, with Southern Africa sending 29.7% of exports to neighbors.

That’s likely driven by exports from South Africa, the largest exporter in 2019. East Africa also saw a larger amount of trade, accounting for 35.0% of their exports in 2019, likely driven by Zambia and Kenya, the largest exporters in the region.

Source: Panjiva

Brush-fires still smouldering

Outside of the new “great game” of U.S.-China rivalry and both sides’ attempts to draw in allies, there are a great many regional rivalries that could disrupt the steady process of global trade liberalization in 2021.

The most serious of these is the ongoing state of relations between China and Australia. Founded in China’s complaints regarding Australia’s commentary and actions towards China’s domestic policies and implemented via Chinese restrictions on imports from Australia including coal and other commodities, the matter may prove to be a test case both for the Biden administration’s international engagement and China’s approach to other midsized economies globally. Canada and the U.K. may look on with concern.

The increasing focus among EU member states on the environmental aspects of trade deals has put a halt on approval of the long-awaited EU-Mercosur trade deal following French complaints regarding Brazil’s deforestation policies. Little progress is likely at least until the Brazilian elections in 2022.

Rivalry between Japan and South Korea spilled into the trade sphere in 2019 with a pause in escalation due to the pandemic and in the name of completing the RCEP trade deal. Both sides still have yet to put trusted trader status back in place. Japan’s new Prime Minister, Yoshihide Suga, reportedly wants to repair relations between the two countries, potentially resulting in a de-escalation in trade tensions in 2021.

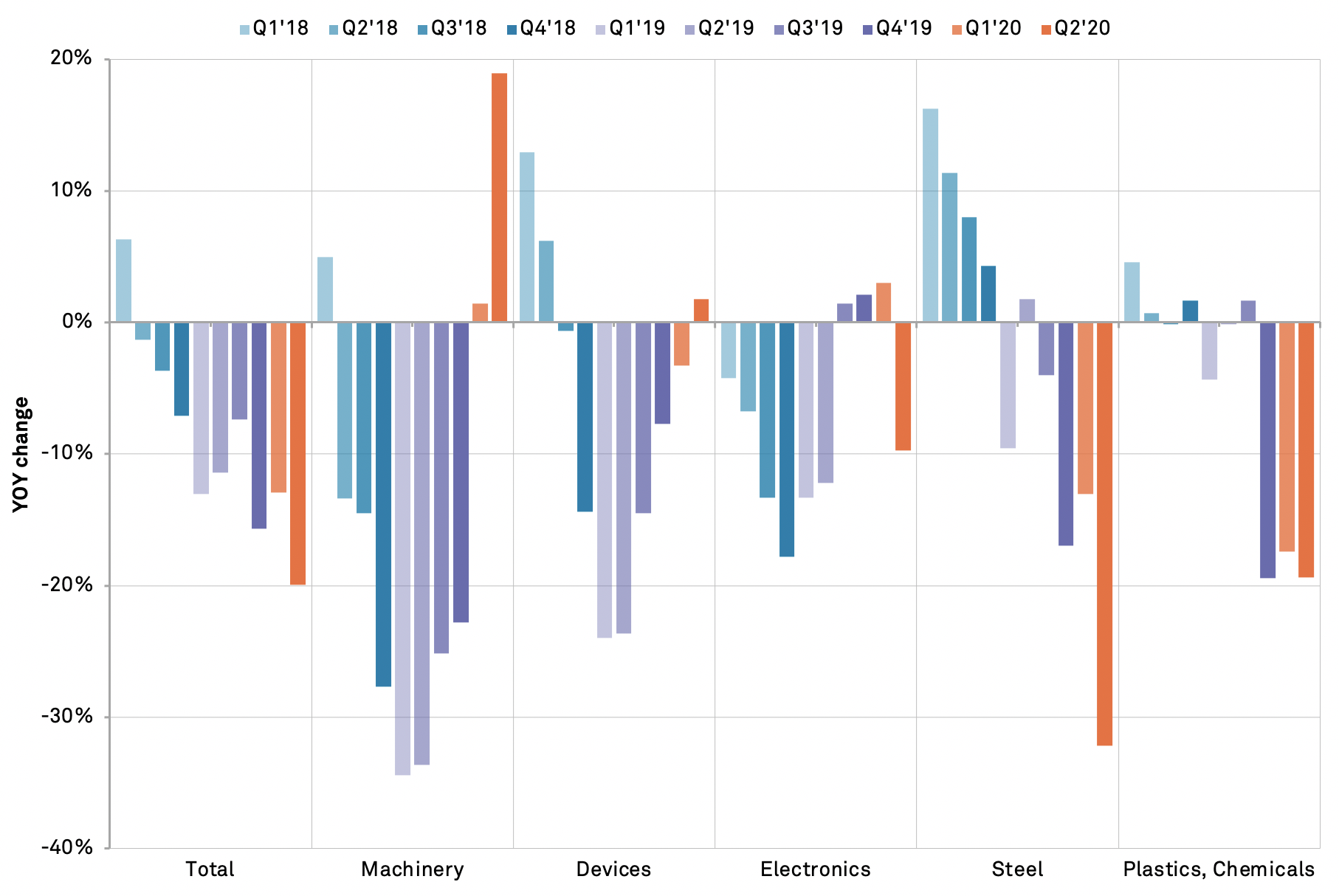

Panjiva’s data shows that South Korea remains Japan’s third largest export market despite a 11.9% drop in 2019 which extended to a 16.4% slide in the first half of 2020 due to the impact of the pandemic. The decline in 2019 was led by a 29.8% drop in imports of machinery (HS 84) ranging from auto parts through consumer devices while imports of medical and measuring devices (HS 90) dropped by 18.0%. In 2020 the fastest rate of decline has been seen in steel, which dropped by 23.1% in the first half of 2020 while imports of chemicals – where Japan restricted exports of items needed in the production of semiconductors – dropped by 18.4%.