ENG

-

ABOUT US

James Forwarding

- BUSINESS

-

JFC NEWS ROOM

JFC NEWS ROOM

-

CONTACT US

CONTACT US

JFC NEWS

2022.04.13 Siberian detour forces airlines to retrace Cold War Era Routes

- 2022-04-13

- 1,170

Global airlines are going to great lengths to avoid Russian airspace but few to the extent of Finnair Oyj, the flag carrier of Finland. It’s flying thousands of miles around its northern neighbor, retracing routes abandoned decades ago at the end of the Cold War.

The economic burden of those end-runs is measured in additional jet fuel burn, extended duty times, and the potential for more crews being required on some longer flights. Airlines may face additional maintenance costs for heavier use of their long-haul jets and some new overflight fees from countries they may not have traversed previously. And, of course, there’s the extra time customers will spend in transit.

The diversions also are blowing a big hole in airlines’ commitments to reduce greenhouse gas emissions.

“The impact of these is so great, that at this stage we are unfortunately not able to offer passenger connections to all of our Asian destinations,” Perttu Jolma, vice-president of Finnair’s traffic planning team, wrote in a March 7 company blog.

The Nordic carrier—which until recently touted itself as offering the shortest routes from Europe to Asia—scrapped its Northeast Asian flights and re-routed trips to Southeast Asia after being banished from Russian airspace.

“We’ve had to rethink all our Asian services after the ban on using Russian airspace,” said spokeswoman Paivyt Tallqvist, noting variables like prevailing winds determine if the company routes planes north or south of Russia.

17 Hour Flights

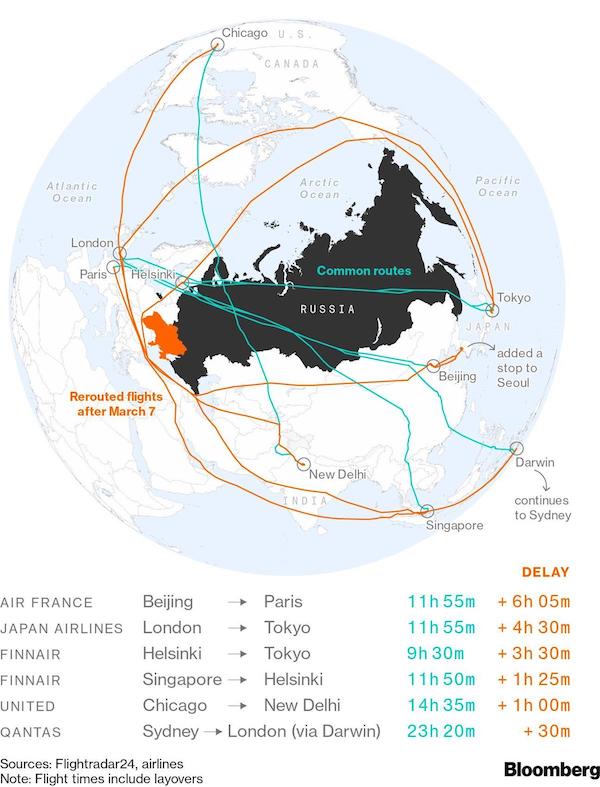

Since Russia’s Feb. 24 invasion of Ukraine, at least 21 airlines have rerouted flights to avoid either Russian airspace or the western portion of Ukraine, according to tracking firm FlightRadar24. The less-direct routings add as much as three hours on most Europe-Asia routes.

United Airlines Holdings Inc. canceled two of its four flights to India after deciding to end Russian overflights on March 1. Trips from San Francisco to Delhi and Newark, New Jersey to Mumbai wouldn’t work without re-fueling or heavily restricting the amount of cargo and passengers. That’s a deal breaker for many flights.

United is routing its Newark-Delhi flights over Saudi Arabia and its Chicago-Delhi flight over Turkey, Turkmenistan and Tajikistan. But the return flight to Chicago is 17 hours, two hours longer than using Russian airspace, according to data from tracking service FlightAware.

One of the world’s longest flights, Qantas Airways Ltd.’s Sydney-Darwin-London service, flies through the Middle East and southern Europe instead of traversing China and Russia, adding 60 minutes to flights already pushing 17 hours long, the company said last month.

All those extra miles mean more fuel burn.

An Airbus SE A350-900, which Finnair uses for longer routes, consumes roughly 1,830 gallons of fuel per hour at a typical cruise speed, according to data compiled by Robert Mann, an aviation analyst in Long Island, New York. At the March 10 settlement price of $3.20 per gallon in Europe, based on Platt’s data, an extra three hours would add more than $17,000 in additional fuel expense. (The A350-900 can carry 37,248 gallons of fuel, or 141,000 liters.)

Likewise, the extra 4.5 hours Japan Airlines Co. needs for its London to Tokyo routing via Canada and Alaska runs over $20,000 in extra fuel for the Boeing Co. 787-9 on the route, based on current jet fuel prices.

This additional fuel use, if it persists, could further complicate airlines’ goal of achieving zero net carbon emissions by 2050, an ambitious target the International Air Transport Association adopted in October.

Pricier Jet Fuel

The sudden circuity following Russia’s invasion of Ukraine comes just as airlines are slammed by another aspect of the war: A spike in jet fuel prices owing to the geopolitical turbulence and the U.S. ban of Russian oil imports, announced March 8, a move the United Kingdom is likely to follow in coming months.

In the past month, spot fuel prices have surged 26% to $116 per barrel of Brent crude as of Thursday. Brent crude futures price climbed as high as $139 intraday on March 7.

Japan’s largest airline, All Nippon Airways Co. Ltd, is considering raising fares on rerouted flights to Europe, the Japanese newspaper Nikkei reported this week, citing an interview with the carrier’s new chief executive.

The industry tumult follows two years of a pandemic that sent air travel demand to historic lows, with much international traffic still below 2019 levels. Getting around the globe in a timely and cost-effective manner has become an added conundrum.

Air France has altered flight paths for five Asian destinations from Paris, including Beijing and Tokyo, to fly a southerly route over Turkey, Kazakhstan and China. The reroutes add one to two hours per flight, the carrier said.

Japan Airlines Co. Ltd. is routing its Tokyo service to London using a longer northern route via Alaska and Greenland. Views of Arctic tundra are scant comfort for passengers: Flight times to London take an extra three hours, adding to an average 12-hour trip.

Cold War Thaw

After the collapse of the Soviet Union in 1991, global airlines begin exploring routine flights over Russia to save time and money. Finnair started trans-Siberian service after a bilateral agreement entered into force in 1994.

Before the pandemic traffic between Asia and Europe accounted for more than half of Finnair’s revenue. Higher prices for cargo shipments have helped offset some of the lost revenue, but the cuts to service have been painful.

New limits on destinations and less frequent flights mean fewer workers are needed. The airline has started talks on laying off some crews temporarily, which come on top of pandemic-induced furloughs.

“We now expect to furlough about 100 to 180 pilots and 150 to 380 cabin crew,” Tallqvist said.

Source : - AJOT